Hi there, unicorns!

This week, we’re breaking down Spotify’s growth playbook – the music streaming giant that revolutionized how we consume tunes.

From a simple idea to solve music piracy to a global phenomenon valued at over $30B, Spotify has grown into the world’s leading audio streaming platform with over 456 million users across 180+ markets.

But the path to the top wasn’t always smooth sailing.

In this growth playbook, we’ll reveal the strategies and tactics that led Spotify to success, explore its impact on the music industry, and examine how it navigated the ups and downs of its journey.

Grab your headphones, and let’s hit play! 🎧

The Idea💡

It was a cold winter night in Stockholm in 2006.

Two friends and successful startup founders, Daniel Ek and Martin Lorentzon, were brainstorming their next big thing.

Frustrated by the piracy in the music industry (remember Napster good ‘ol days?) and the lack of legal alternatives, they wondered:

What if you could stream any song instantly without having to own it?

This idea, born from a very real need, would become the foundation of Spotify.

Ek and Lorentzon envisioned a platform that could offer the convenience of piracy with the legitimacy of paid services.

Their core concept was brilliantly simple:

Create a service where users can access millions of songs on-demand, legally and affordably.

The Problem 😫

Before Spotify, the music industry was in crisis.

Piracy was rampant, and legal options were limited and clunky.

Consumers faced a tough choice:

- Pay $0.99 per song on iTunes (ouch for music lovers!)

- Buy entire albums for $10-$15 (for maybe 2-3 good songs?)

- Pirate music (free but illegal and often poor quality)

The industry was hemorrhaging money, with global revenue plummeting from $23.8B in 1999 to $14.3B in 2014.

Artists were struggling to make money from their music.

Listeners wanted access to a vast library of music without breaking the bank or the law.

The music world was crying out for a disruption that would satisfy both creators and consumers.

The MVP 🛠️

Spotify’s Minimum Viable Product was much simpler than the full-featured app we know today:

- A desktop-only application

- Invite-only access, limited to Sweden

- A basic music player interface

- Ability to stream a limited catalog of music

- Simple search functionality

The initial version didn’t include many features we now associate with Spotify, such as playlists, social sharing, or even a mobile app.

This bare-bones MVP allowed Spotify to test their core value proposition:

Instant, legal access to a wide range of music.

By limiting it geographically and controlling access through invites, they could manage growth and gather crucial feedback.

The focus was on proving that users wanted on-demand streaming and that it could work technically.

Everything else came later.

Product-Market Fit 🎯

Spotify’s journey to product-market fit was a gradual process of expanding its service and user base.

The initial invite-only launch in Sweden provided strong evidence that users craved on-demand streaming.

Early adopters were hooked, spending hours on the platform and happily sharing invites with friends.

Key indicators of PMF included:

- Rapid user growth: From 1 million users in 2009 to 10 million by 2011

- Strong engagement: Users spending 70+ minutes per day on the platform

- Viral growth: Each new user was inviting multiple friends

- Increasing willingness to pay: Premium conversions growing steadily

Spotify achieved PMF in stages:

- First, in Sweden and other Nordic countries

- Then across Europe

- Finally, with its 2011 US launch

The US launch was a pivotal moment, with Spotify gaining 1 million subscribers in just 5 months.

By solving the dual problems of music accessibility for users and piracy for the industry, Spotify had found its sweet spot.

The product people wanted, delivered in a way that worked for both consumers and the music industry.

Positioning & Branding 🎨📐

Spotify positioned itself as the ultimate music companion – “Music for every moment” became their mantra.

Their branding strategy focused on:

- Simplicity: Clean, intuitive interface with a distinctive green and black color scheme.

- Personalization: Emphasizing curated playlists and discovery features.

- Accessibility: “Music for everyone” – highlighting their vast library and freemium model.

- Innovation: Positioning as a tech company, not just a music service.

Spotify’s logo, a simple circle with three curved lines, evoked sound waves and became instantly recognizable.

Their marketing often focused on the emotional connection between people and music, with campaigns like “For Music” and “Wrapped” tapping into personal listening habits.

Spotify also positioned itself as an ally to artists, promising a platform where musicians could reach fans directly and earn fair compensation.

This branding helped Spotify stand out, appealing to both casual listeners and audiophiles while also gaining credibility within the music industry.

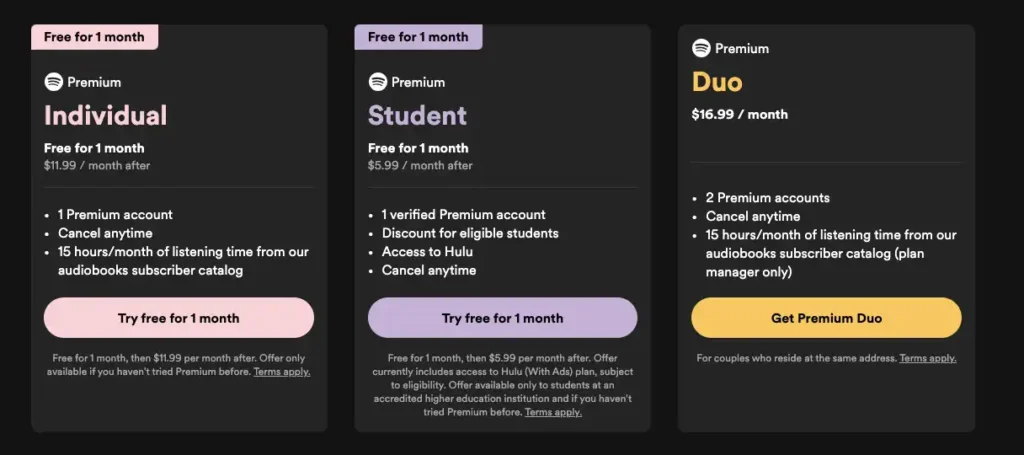

Pricing 💰📊

Spotify’s freemium model is a cornerstone of their success, but it didn’t start that way.

Initially, Spotify offered only paid subscriptions in some markets.

The freemium approach evolved as Spotify expanded, offering a free tier with ad-supported, limited features, a Premium tier at $11.99/month with ad-free, full features, and some other plans like Student’s, Duo, and Family.

This model served two purposes:

It lowered the barrier to entry, driving rapid user growth, and created a funnel for premium conversions.

Spotify’s freemium success is remarkable, with a 45% conversion rate from free to paid – industry-leading compared to Dropbox’s ~4% or Evernote’s ~6%.

Key factors in this high conversion rate include limited free mobile features incentivizing upgrades, a high-quality free experience building user habit, a seamless upgrade process, and targeted promotions and family plans.

Spotify’s freemium model has proven highly effective at both user acquisition and monetization, setting it apart from competitors and contributing significantly to its growth.

This balanced approach has allowed Spotify to scale rapidly while building a sustainable revenue model.

Acquisition 🚀

Spotify’s acquisition strategy has used multiple channels and creative campaigns to drive explosive growth and market penetration.

Starting from Sweden in 2008, Spotify’s expansion was methodical yet aggressive:

- 2009: Launched in the UK, achieving 1 million users

- 2011: Expanded to the US, reaching 10 million users globally

- 2013: Available in 32 countries with 24 million active users

- 2016: Reached 100 million users across 60 countries

- 2022: Over 450 million users in 183 markets

Market penetration rates have been impressive:

- In Sweden, their home market, Spotify reached 35% penetration by 2015

- In the UK, they achieved 20% penetration by 2016

- In the US, they grew from 5% in 2014 to 25% by 2020

Spotify employed various tactics for user acquisition:

From the start, Spotify relied heavily on word-of-mouth and the power of exclusivity.

Their initial invite-only system in Sweden created a buzz, with each new user inviting multiple friends.

This viral loop kicked off their initial growth spurt.

As Spotify expanded across Europe and globally, they employed a mix of tactics:

- Strategic partnerships: Collaborations with telecom companies bundled Spotify with mobile plans, instantly reaching millions of potential users.

- Social integration: In 2011, Spotify’s partnership with Facebook allowed users to share their listening habits, driving massive awareness and user acquisition. This integration led to an additional 1 million active users within days.

- Freemium model: The free tier acted as a powerful acquisition tool, allowing users to experience the full value of Spotify before committing to a subscription.

- Influencer marketing: Spotify leveraged relationships with artists and celebrities to promote the platform, particularly during their US launch.

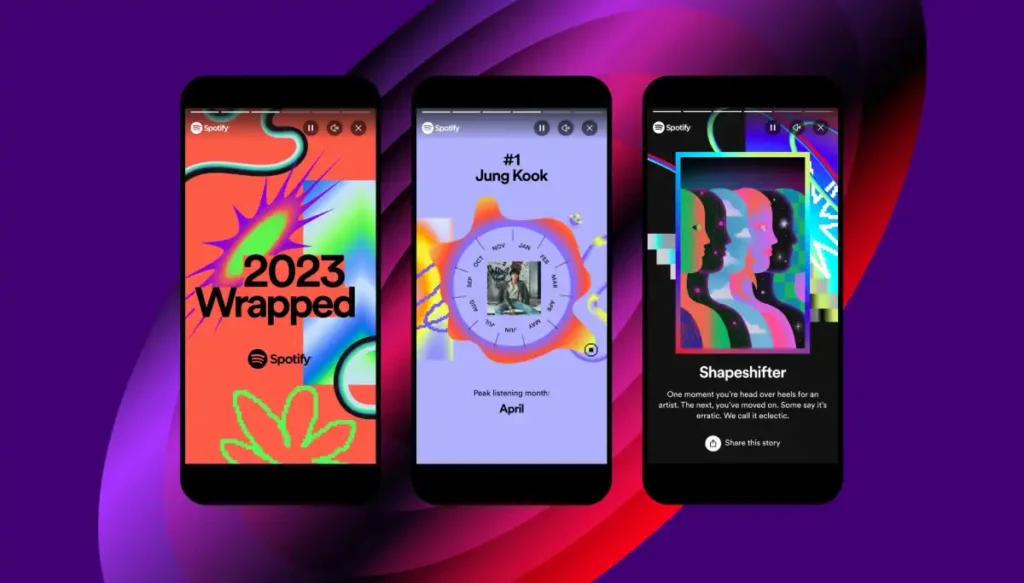

- Content marketing: Spotify’s year-end “Wrapped” campaign, launched in 2013, became a viral sensation, driving significant user acquisition and re-engagement each year.

- Paid advertising: As Spotify matured, they invested heavily in digital and traditional advertising.

- Product-led growth: Features like collaborative playlists and Spotify Codes encouraged existing users to bring new users onto the platform.

In addition to organic growth strategies, Spotify has made several strategic acquisitions to expand its capabilities and user base:

- The Echo Nest (2014, $100M): This music intelligence company enhanced Spotify’s recommendation algorithms.

- Seed Scientific (2015): A data science consulting firm that boosted Spotify’s analytics capabilities.

- Soundtrap (2017): An online music studio startup, expanding Spotify’s creator tools.

- Gimlet Media and Anchor (2019, $340M combined): These podcast companies marked Spotify’s major push into the podcasting space.

- The Ringer (2020, $196M): Bill Simmons’ sports and pop culture outlet further expanded Spotify’s podcast offerings.

- Locker Room/Betty Labs (2021): Rebranded as Spotify Greenroom, this moved Spotify into live audio.

- Findaway (2021): An audiobook platform, signaling Spotify’s expansion beyond music and podcasts.

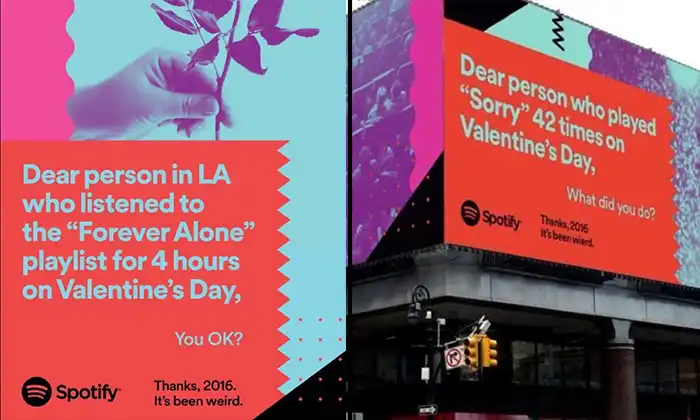

However, what truly set Spotify apart were their iconic, data-driven marketing campaigns:

- “Thanks, 2016. It’s Been Weird.”: This billboard campaign used quirky, localized listener data to create humorous and shareable content. For example, “Dear person who played ‘Sorry’ 42 times on Valentine’s Day, what did you do?”

- “Your 2017 Wrapped“: This personalized year-in-review campaign took user data to the next level, creating individual listening summaries for each user. It was so popular it became an annual tradition, eagerly anticipated by users worldwide.

- Mood-based playlists: Spotify created playlists for every conceivable mood or activity, from “Life Sucks” to “Shower Songs,” making the platform indispensable for every moment of users’ lives.

- Spotify.me: This interactive website allowed users to dive deep into their listening habits, providing shareable infographics and insights.

These campaigns not only drove user acquisition but also increased engagement and retention, as users eagerly shared their unique Spotify experiences on social media.

The results speak for themselves:

Spotify grew from 1 million users in 2009 to 10 million by 2011, 100 million by 2016, and over 450 million by 2022.

Their user base doubled approximately every two years in their first decade.

This multi-faceted approach, combining traditional acquisition tactics with innovative, data-driven campaigns, allowed Spotify to achieve unprecedented growth, reaching global dominance in the music streaming market faster than any competitor.

Growth Loops 🔄🚀

Spotify’s growth is powered by two interconnected loops that create a powerful network effect:

Retention Loop:

- Users discover personalized playlists and recommendations

- Engagement increases as users find more music they love

- Higher engagement leads to more data for better recommendations

- Improved recommendations increase user satisfaction and retention

- Retained users generate more data, restarting the cycle

Acquisition Loop:

- Existing users share playlists, songs, and yearly “Wrapped” summaries

- Non-users see these shares on social media

- Curiosity drives new user sign-ups

- New users start creating and sharing their own content

- The cycle repeats, bringing in more new users

These loops are amplified by Spotify’s viral “Wrapped” campaign:

- Users receive personalized year-end listening summaries

- The beautifully designed, shareable content has high social value

- Users eagerly share their “Wrapped” stories on social media

- Non-users see these shares, driving curiosity and new sign-ups

- The annual nature creates anticipation and re-engagement

Spotify has also experimented with higher-frequency features like “Today’s Top Fans” to create more consistent growth impulses throughout the year.

The combination of these loops creates both a standard network effect (more users = more valuable for everyone) and a data network effect (more user data = smarter algorithms = better experience for all users).

This dual loop strategy has been crucial in Spotify’s rapid growth, helping them reach 456 million users across 180+ markets.

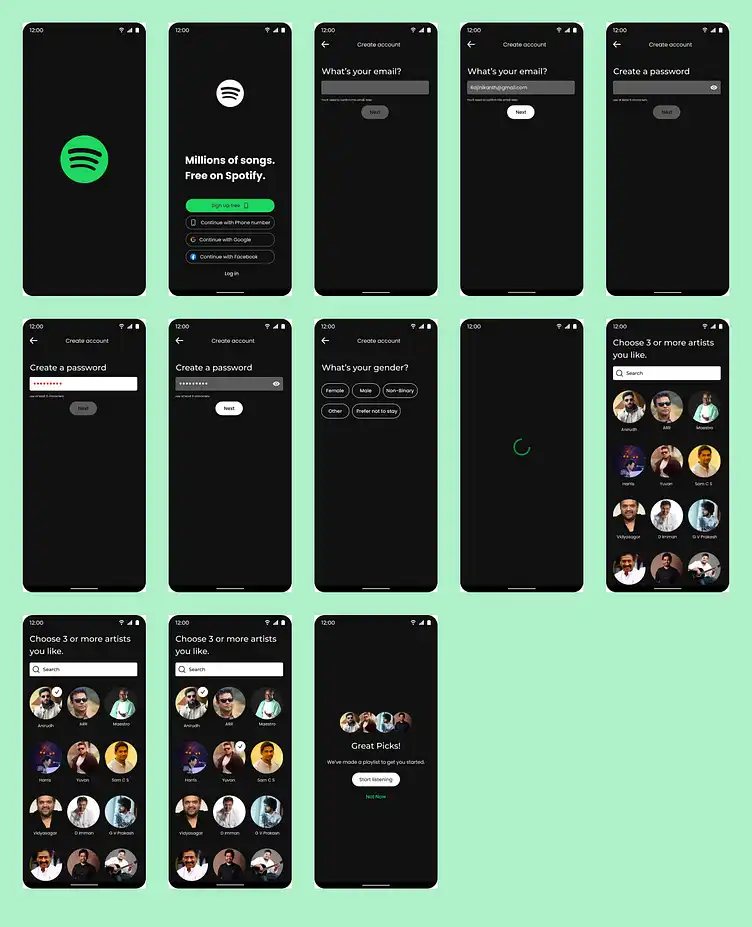

Activation 🎬🔥

Spotify’s activation strategy focuses on guiding users to their ‘Aha Moment’ as quickly as possible.

This critical moment occurs when users create their first personalized playlist or discover a new artist based on their listening habits.

To accelerate this process, Spotify employs several tactics.

Upon signup, users complete a brief onboarding questionnaire where they select their favorite artists and genres.

This allows Spotify to immediately offer personalized recommendations, providing instant gratification within seconds of joining the platform.

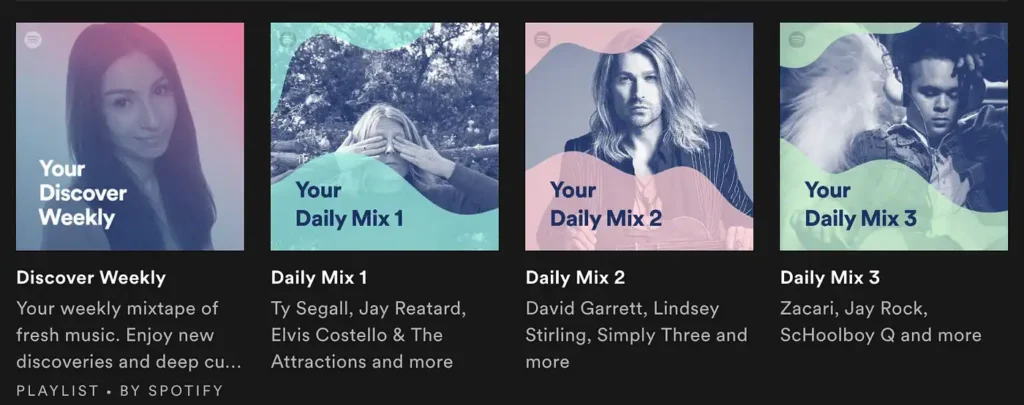

Key features like Discover Weekly, introduced in 2015, and Daily Mix, launched in 2016, play crucial roles in activation.

Discover Weekly provides each user with a curated playlist of new music every Monday, while Daily Mix combines familiar tracks with fresh recommendations.

These features encourage regular engagement and facilitate the discovery process that’s central to Spotify’s value proposition.

Additionally, tools like Spotify Radio allow users to start a station based on any song, artist, or playlist, further aiding music discovery.

By focusing on personalization and discovery from the very beginning, Spotify guides users to create their own playlists and find new music they love, deepening their connection to the platform and increasing the likelihood of long-term retention.

Retention 🔒❤

Spotify’s retention strategy hinges on its powerful AI-driven personalization, creating a deeply engaging and tailored experience for each user.

At the core of this strategy is Spotify’s sophisticated recommendation engine, which analyzes user listening habits, playlist creation, and even the time of day they listen to certain genres.

This data fuels features like Discover Weekly, Release Radar, and Daily Mix, which serve up fresh, personalized content regularly.

The platform’s ability to learn and adapt to user preferences keeps the experience fresh and relevant.

For example, the ‘Made For You‘ section offers an array of playlists customized to individual tastes, from mood-based selections to genre-specific recommendations.

Spotify’s annual ‘Wrapped‘ campaign, launched in 2015, has become a retention powerhouse.

By gamifying users’ yearly listening data, it creates a much-anticipated event that re-engages users and sparks social sharing.

The introduction of podcasts and exclusive content further diversifies the offering, giving users more reasons to stay on the platform.

This multi-faceted approach to personalization and content variety has helped Spotify maintain an industry-leading churn rate of just 4.9% (as of Q1 2023).

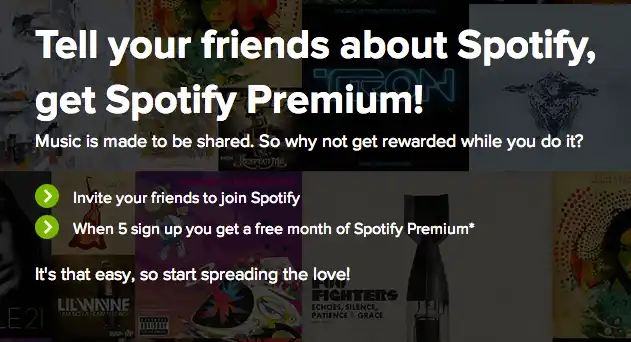

Referral 📣🎉

Spotify’s referral strategy has evolved significantly over time, leveraging both formal programs and organic sharing features.

Initially, Spotify offered a formal referral program with attractive rewards.

In its first iteration, referrers received a free 1-month premium when a friend started a Premium free trial.

Later, they introduced double-sided rewards, giving the referrer one month of premium and the friend two months.

However, as Spotify’s user base grew to 5 million, they adjusted the program, limiting referrals to five friends and removing the reward for the referred friend.

Eventually, Spotify discontinued its formal referral program, focusing instead on organic growth and premium conversions.

Despite the absence of a formal program, Spotify’s platform is inherently social, encouraging organic referrals through features like:

- Collaborative playlists: Users can create and share playlists with friends.

- Social sharing: Easy integration with social media platforms to share songs and playlists.

- Spotify Codes: Unique, scannable codes for sharing tracks, albums, and playlists.

- Friend Activity feed: Showing what friends are listening to in real-time.

Challenges 😰

Despite its success, Spotify faces several significant challenges:

- Profitability: Spotify has struggled with consistent profitability. In Q3 2023, the company reported its first quarterly operating profit in over a year, but long-term profitability remains a challenge.

- Royalty disputes: Spotify continually grapples with criticism over its royalty payment model. High-profile artists like Taylor Swift have removed their catalogs from the platform over payment disputes.

- Competition: The streaming market is increasingly crowded with rivals like Apple Music, Amazon Music, and YouTube Music, putting pressure on user acquisition and retention.

- Content costs: Licensing fees for music remain a significant expense, accounting for about 70% of Spotify’s revenue.

- Podcast investment risks: Spotify’s massive investments in podcasting, including a reported $100 million deal with Joe Rogan, have yet to fully pay off.

- Market saturation: In mature markets, Spotify faces the challenge of continued growth as it reaches saturation points.

Lessons Learned 🎓

Spotify’s journey from a Swedish startup to a global audio streaming giant offers some killer insights for aspiring entrepreneurs and growth pros:

Lesson 1: Freemium Can Work Wonders

Spotify’s freemium model drove massive user adoption while still converting a significant portion to paid subscribers.

The takeaway? Find the right balance between free and premium features to attract users and monetize effectively.

Lesson 2: Personalization is King

Spotify’s success is largely built on its ability to deliver highly personalized experiences through AI and machine learning.

The takeaway? Invest in understanding your users’ preferences and behaviors to create tailored experiences that drive engagement and retention.

Lesson 3: Turn Data into Delight

Spotify’s “Wrapped” campaign shows how user data can be transformed into shareable, engaging content.

The takeaway? Look for creative ways to use your data to not only improve your product but also to create marketing moments that users love to share.

Lesson 4: Timing is Everything

Spotify entered the market when piracy was rampant and legal alternatives were limited.

The takeaway? Keep an eye on market trends and pain points – timing your entry right can be crucial for success.

Lesson 5: Build an Ecosystem

By expanding into podcasts and providing tools for artists, Spotify is building a broader audio ecosystem.

The takeaway? Look for ways to diversify your offering and create an ecosystem around your core product to increase user stickiness and open new revenue streams.

And there you have it! 🎉

Spotify’s journey from a Swedish startup to the world’s leading audio streaming platform is a masterclass in growth and innovation.

From its clever freemium model to its data-driven personalization, Spotify has rewritten the rules of the music industry and user engagement.

But as we’ve seen, even with 456 million users, the path isn’t always smooth.

Profitability challenges, artist disputes, and fierce competition remind us that sustainable success requires constant evolution and balancing act between user experience and business viability.

Found this fascinating? Spread the love and share with your fellow growth geeks!

Till next time, keep streaming… err, growing! 🎵🚀

Leave a Reply