Hello, growth enthusiasts!

This week, we are reveling the growth playbook of Robinhood – the fintech startup that changed the world of investing.

With a mission to democratize finance for all, Robinhood has reached over 22 million users and a valuation of $11.7 billion.

But the road to the top wasn’t always smooth, as the company faced its fair share of controversies and challenges along the way, like the GameStop short squeeze shenanigans.

In this growth playbook, we’ll discover the strategies and tactics that drove Robinhood to success, explore its impact on the investing landscape, and examine how it navigated the ups and downs of its journey.

So grab your favorite drink, and let’s get into it!

The Idea💡

Robinhood’s founders, Vladimir Tenev and Baiju Bhatt, recognized a problem in the investing world:

Traditional brokerages served only wealthy, experienced investors, leaving younger generations and those with less capital on the sidelines.

Their solution?

Create a commission-free trading app that makes investing accessible to everyone, regardless of their financial background.

By combining a mobile app with an engaging, gamified user experience, Robinhood tried to break down the barriers to entry and take over the new generation of investors.

The core idea was simple yet powerful:

Make investing easy, affordable, and enjoyable for the masses.

The Problem 😫

Before Robinhood, the world of investing was dominated by traditional brokerages that targeted only wealthy or experienced investors.

These brokerages charged high commission fees, required minimum account balances, and offered complex trading platforms that scared noob investors.

As a result, many younger generations and individuals with less capital found themselves excluded from the investment landscape.

This lack of accessibility not only caused financial inequality but also prevented a significant portion of the population from participating in the stock market game.

Robinhood recognized this problem and set out to create a solution that would democratize investing for all.

The MVP 🛠️

Robinhood’s initial MVP had nothing to do with the traditional MVPs of other companies.

It was just a clever pre-launch landing page designed to generate buzz and capture user interest.

This landing page’s goal was to create a waitlist where potential users could sign up to gain early access to the app.

But there was a twist:

Users could move up the waitlist by referring friends, gamifying the pre-launch experience.

This referral mechanism tapped into people’s fear of missing out (FOMO) and incentivized them to spread the word.

Product-Market Fit 🎯

Robinhood’s unconventional one-year pre-launch campaign was a genius move that validated their idea and set the stage for hockey stick growth.

Instead of rushing to market, the founders took a patient approach, building anticipation and demand through a gamified waitlist and referral program.

As the waitlist grew from thousands to over one million users, it became clear that Robinhood had tapped into a massive unmet need in the market.

The overwhelming response proved that younger generations and underserved investors were hungry for an accessible, commission-free trading platform.

By the time Robinhood launched, they had already achieved an impressive level of product-market fit, with a highly engaged user base ready to use their app.

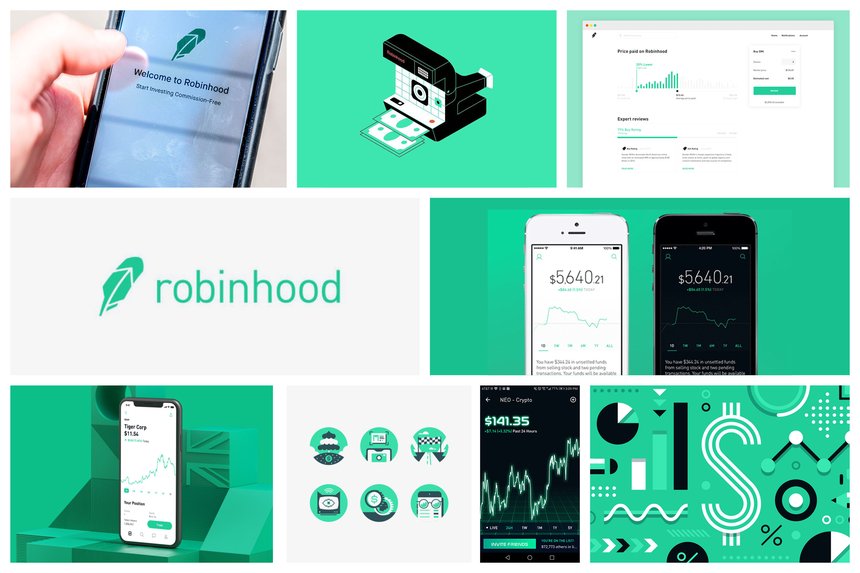

Positioning & Branding 🎨📐

Robinhood’s positioning was crystal clear from the start:

They were the voice of everyday investors, democratizing access to the stock market.

Their name, inspired by the legendary outlaw who stole from the rich to give to the poor, perfectly aligned with their mission to level the playing field.

Robinhood’s branding was sleek, modern, and approachable, with a bold color palette and engaging illustrations that appealed to younger generations.

Their messaging emphasized simplicity, accessibility, and empowerment, with taglines like “Investing for Everyone” and “Democratizing Finance for All.”

Across every touchpoint, from their app design to their marketing campaigns, Robinhood consistently reinforced their positioning as the go-to platform for a new generation of investors.

Pricing 💰

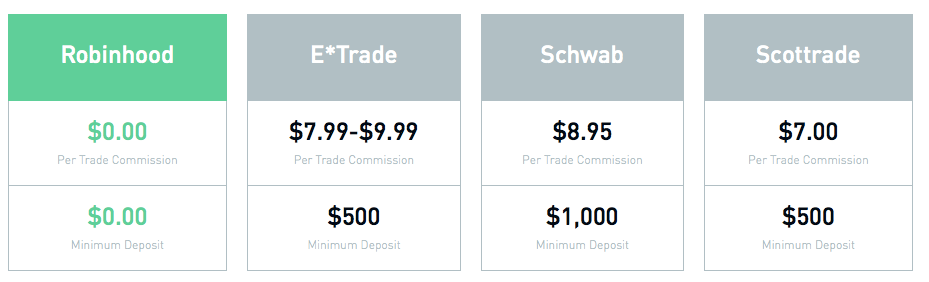

Robinhood’s pricing strategy disrupted the world of investing.

By offering commission-free trades, they removed the traditional barriers to entry and made investing accessible to everyone.

While competitors charged up to $10 per trade, Robinhood’s zero-commission model was exactly what retail investors were looking for.

But how did they make money?

Through a combination of interest on cash balances, margin lending, and payment for order flow.

This innovative approach not only attracted millions of users but also forced other brokerages to adapt, ultimately revolutionizing the industry.

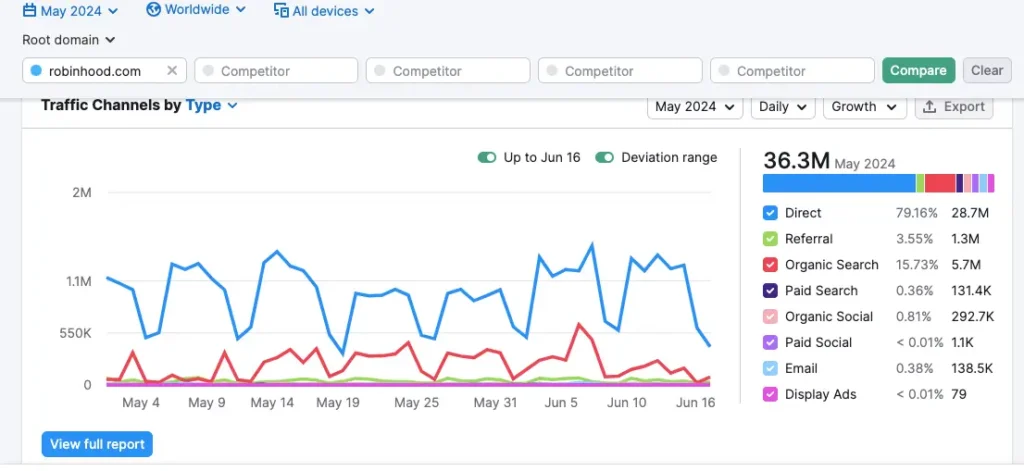

Acquisition 🚀

Robinhood’s acquisition strategy was all about tapping on the power of word-of-mouth and viral growth.

Their pre-launch referral program was the stuff of legend, with users sharing their unique invite links to move up the waitlist and score free stocks.

This gamified approach tapped into people’s natural desire for competition and rewards, fueling a viral loop that drove millions of sign-ups before the app even launched.

But Robinhood didn’t stop there.

They continued to use the power of referrals post-launch, offering free stocks to both the referrer and the referee.

This double-sided incentive not only encouraged users to keep spreading the word but also gave new users a taste of the thrill of investing.

Robinhood’s referral program was so successful that it became a key driver of their growth, accounting for over 50% of new user acquisitions in some periods.

But Robinhood didn’t just rely on referrals.

They also used influencer marketing, partnering with popular YouTubers and Instagram personalities to reach new audiences.

By tapping into the trust and credibility of these influencers, Robinhood was able to expand their reach and attract users who might have been hesitant to invest on their own.

Finally, Robinhood’s own users became their best acquisition channel.

As more and more people understood the app’s valye, they naturally shared their experiences with friends and family.

This organic word-of-mouth growth was proof of the strength of Robinhood’s product and the loyalty of their user base.

Growth Loops 🔄

When it comes to growth loops, Robinhood has mastered the art of viral referrals. 🦠

Here’s how their referral loop works:

Step 1: User Signs Up 🎉

A new user signs up through a referral link and gets a free stock, instantly hooked on the thrill of investing.

Step 2: User Engages and Unlocks Rewards 🏆

The user explores the gamified app, makes trades, and unlocks rewards, fueling their excitement.

Step 3: User Shares with Friends 📣

Excited by their experience, the user shares their referral link with friends and family.

Step 4: Network Effects Amplify 🌍

As more users join and share, network effects kick in, exponentially growing Robinhood’s user base.

Step 5: Loop Repeats 🔄

The referral loop continues, with each new user fueling further growth and engagement.

Activation 🎬🔥

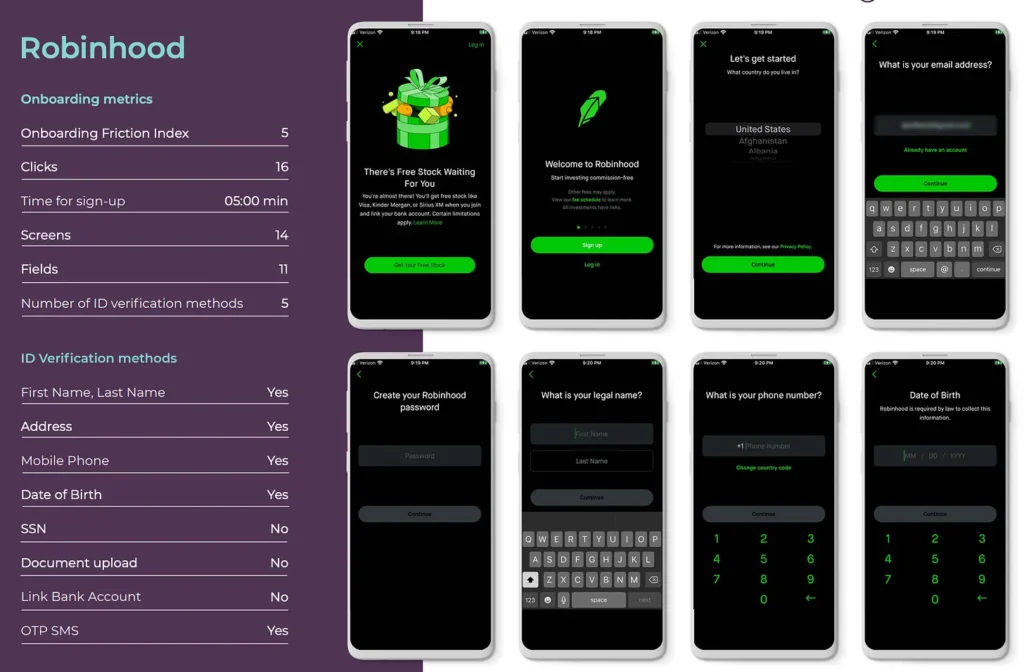

By keeping input fields to a minimum and providing clear instructions, Robinhood makes it easy for users to complete the sign-up process.

Robinhood also carefully balances the need for identity verification with the desire for a frictionless experience.

While some competitors bog down users with document uploads and bank linking, Robinhood opts for a simpler approach.

They understand that slightly higher fraud risk is worth the trade-off for a smoother onboarding experience.

The result?

Robinhood has the fewest clicks required for sign-up among its fintech competitors.

By reducing friction at this crucial stage, Robinhood sets users up for success and increases the likelihood of long-term engagement.

In a highly regulated industry, Robinhood proves that activation can still be optimized through smart design choices and a relentless focus on the user experience.

Retention 🔒

Robinhood’s retention strategy is a critical area for improvement, as evidenced by the decline in monthly active users despite surprise profits.

To boost retention and encourage more frequent trading, Robinhood should focus on boosting its platform’s reliability and offerings for serious traders.

Probably the only part of Robinhood’s retention strategy is their daily “Robinhood Snacks” newsletter.

This engaging and informative email keeps customers in the loop with major stock moves, news summaries, and in-depth stories.

By providing valuable content in a fun, scannable format, Robinhood demonstrates an understanding of their customers’ needs and preferences.

However, to truly improve retention, Robinhood must go beyond email marketing and address the core issues affecting user trust and engagement.

Investing in a more comprehensive trading platform, akin to E*Trade’s offerings, could help Robinhood become a one-stop-shop for executing and selecting trades.

Additionally, by prioritizing quality customer service and system performance, Robinhood can reduce the monetary and reputational damage caused by outages and technical failures.

Referral 📣

By now, you understand that referral is the beating heart of Robinhood’s growth engine.

Their viral referral program, which rewards both the referrer and the referee with free stocks, has disrupted the fintech world.

This double-sided incentive not only encourages users to spread the word but also gives new users a taste of the thrill of investing.

The referral program has been so successful that it has accounted for over 50% of new user acquisitions in some periods.

But Robinhood’s referral success goes beyond just the program itself.

Their user-friendly platform and engaging content, like the “Robinhood Snacks” newsletter, turn users into loyal advocates who naturally share their experiences with friends and family.

This organic word-of-mouth growth is proof of the strength of Robinhood’s product and the loyalty of its user base.

Lessons Learned 🎓

We can all learn from the journey of Robinhood from a small-scale startup to a $11B fintech firm:

Lesson 1: Democratization Drives Disruption 🌍

By making investing accessible and affordable for everyone, Robinhood disrupted the traditional brokerage industry and unlocked a massive untapped market.

The takeaway? Identify industries ripe for democratization and build products that empower underserved audiences.

Lesson 2: Gamification Engages and Retains 🎮

Robinhood’s gamified user experience, complete with free stocks and achievement badges, keeps users hooked and coming back for more.

The takeaway? Incorporate game-like elements into your product to boost engagement and retention.

Lesson 3: Viral Loops Fuel Explosive Growth 🦠

Robinhood’s referral program, which rewards both the referrer and the referee, created a viral loop that led the app to millions of users.

The takeaway? Design referral programs that incentivize sharing and create self-reinforcing growth cycles.

Lesson 4: Simplicity Beats Complexity 😌

Robinhood’s streamlined onboarding and user-friendly interface prove that in the world of finance, simplicity is a powerful differentiator.

The takeaway? Prioritize simplicity and ease-of-use in your product design, especially when into complex industries.

Lesson 5: Controversy Can Be a Double-Edged Sword

Robinhood’s rise was not without its fair share of controversies, from technical outages to run-ins with regulators.

The takeaway? Be prepared to face the challenges that come with rapid growth and disruption, and always prioritize transparency and customer trust.

Robinhood’s growth playbook is full of lessons for anyone looking to shake things up.

From democratizing investing to nailing gamification and viral loops, they’ve rewritten the retail investing rules and inspired a new generation of innovators.

But rapid growth comes with bumps in the road, and Robinhood had to navigate their fair share of challenges.

Found this fascinating?

Spread the love and share with your fellow growth geeks!

Till next time! ✌️

Leave a Reply