Hey there, growth enthusiasts! 👋

Today we’ll talk about how the banking disruptor Revolut pulled off hockey stick growth to reach a $33B valuation!

Hang tight cause this fintech unicorn’s sauce is juicy…

The Idea 💡

So picture this:

It’s 2015 and founder Storonsky just wants to travel without getting slammed by crap currency exchange rates and fees whenever he uses his bank card abroad.

Lightbulb moment 💡

What if there was a slick app paired with a card letting you exchange and send money worldwide without all those random hidden banking fees?

Ding ding ding! 🛎️

The Problem 😫

Traditional banking was failing customers who needed to manage money globally.

Some major cons were:

💷 Currency Exchange – Up to 5.5% fees

❌ Hidden Fees – Average $153/year

🙅♂️ Bad Customer Support – Over 2 hr wait times

Digital natives demanded flexible, transparent financial services in one seamless interface.

But old-school banks ignored their pain like a petty ex.

Big miss!

The MVP 🛠️

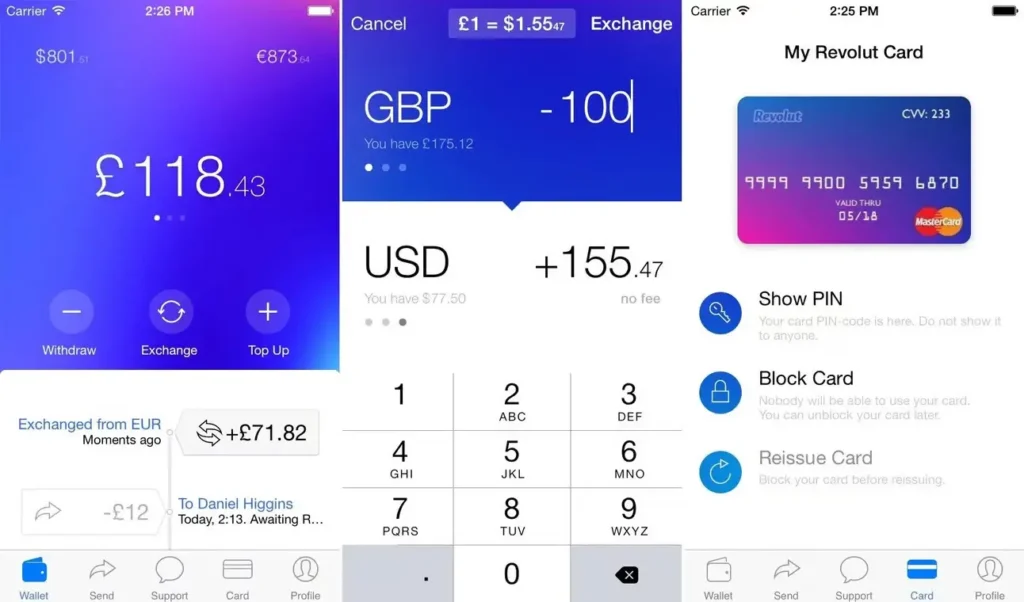

Revolut’s MVP was a simple Mastercard tied to a novel multi-feature app:

🗄️ Multi-Currency Vaults – Store 33 currencies

🔁 Interbank Exchange Rates

👛 Virtual + Physical Cards

📈 Real-Time Spending Notifications

📉 No Hidden Fees, Ever!!

Clean UX + travel payment relief = huge demand signal!

This simple MVP gave Revolut a huge head start by solving the core pain points right out the gate!

Product-Market Fit 🎯

Revolut totally nailed PMF by targeting globe-trotting folk and giving them an affordable, hassle-free banking alt to handle travel money.

They specifically pursued digital-savvy travelers tired of:

👎 Awful exchange rates

💸 Random hidden banking fees

🙅♂️ Dealing with outdated financial tools

Metrics that validated market match:

📈 10% MoM user growth

❤️ 80%+ retention benchmark achieved

🤝 63% of signups via referrals

⭐ 4.8/5.0 app rating

Once adoption/retention/referrals took off like a SpaceX rocket, they knew they found fit!

Boom – product/market alignment confirmed!

Positioning & Branding 🌈

Revolut team knew exactly who their customers were and messaged the new era of flexible global banking for:

🧳 Young professionals

👨💻 Remote workers

✈️ Frequent travelers

💼 Money-savvy biz folks

Brand Identity Communicated Through:

Logo – Digital coin icon

Color – Vibrant purple/pink palette

Fonts – Sleek, sans-serif

Photos – Globetrotters worldwide

Copy – Friendly, straightforward

Consistent messaging about freedom, transparency, and ease:

🚫 No Random Fees!

🌎 Use Anywhere No Fuss

⚡️ Blazing Fast Transfers

💵 Interbank Exchange Rates

🔐 Bank-Level Security

Acquisition 🚀

Revolut onboarded 100,000+ new users within 100 days of launch by:

💰 Targeted Paid Marketing

Facebook Lookalike Audiences for customer targeting

Achieved $0.87 CPA in early spend (Good ol’ days)

🤝 Strategic Travel Biz Partnerships

Partnered with 500+ travel brands

Integrated Revolut as payment option

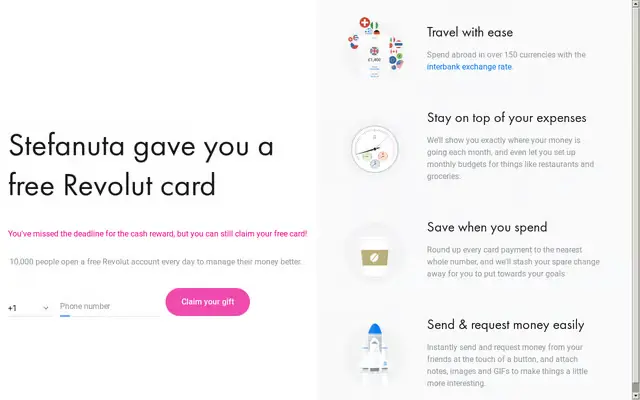

👥 Referral Program

Average user referred 5 friends

Up to $20 reward per referee

38% conversion rate

Then, tailored strategies for global expansion:

🌎 Localized Email Campaigns

Personalized local market emails

2.8x higher CTR than generic

🔋 App Store Optimization (ASO)

Keywords/translations for each region

Country-specific creatives

Support for 44 languages

Usage +10% per translation

With so many digital channels working together, growth stacked on growth!

Growth Loops 🔄

Revolut has mastered the art of creating self-reinforcing mechanisms that keep users engaged and attract new ones like moths to a flame.

Let’s break down these growth loops one by one:

Offline to Online Loop 🌐

- A user receives their sleek, eye-catching Revolut card in the mail.

- Excited about their new toy, the user shares a photo of the card on social media, generating buzz and curiosity among their friends.

- Intrigued by the cool card design, the user’s friends sign up for Revolut, starting the loop all over again.

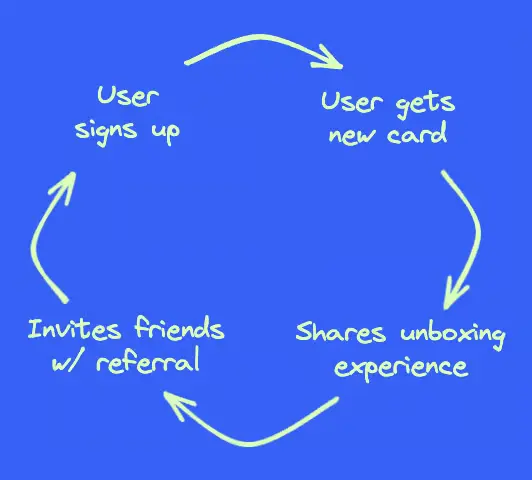

Referral Loop 🎁

- Revolut keeps users hooked with a barrage of push notifications, reminding them of the app’s amazing features and benefits.

- Users are rewarded with enticing perks, discounts, and cashback offers for using their Revolut card, encouraging them to use it more frequently.

- The gamified referral program makes referring friends a fun and rewarding experience, bringing more new users into this loop.

Product Virality Loop 📲

- Revolut’s app is packed with features designed to be shared, like the bill-splitting function that makes ridiculsly easy to split expenses with friends.

- Users share these cool features on social media, exposing the app to new potential users.

- New users join Revolut to take advantage of these viral features, and the cycle continues.

Activation 🎬

Revolut’s activation strategy is all about guiding users to their “aha moment” – that sweet action when they realize the app’s true value.

For Revolut, there are two key “aha moments” that users can experience:

1️⃣ Discovering how effortless it is to exchange currencies at unbeatable rates.

2️⃣ Realizing they can send money to friends anywhere in the world, instantly and for free.

To help users reach these revelations as quickly as possible, Revolut has created a killer onboarding experience that showcases the app’s core features and benefits.

The journey begins by guiding users to add funds to their accounts, which they can do in just a few taps.

This is a very crucial step as it allows users to start exploring the app’s functionalities right away.

Next, Revolut encourages users to make their first transaction, either by exchanging currencies or sending money to a friend.

This is where the “aha moment” strikes – users experience the app’s speed, simplicity, and cost-saving benefits firsthand, and that’s when they truly understand the value Revolut brings to their lives.

But Revolut takes it a step further by gamifying the activation process with features like the “Invite 5 friends and get a reward” referral program.

By incentivizing users to bring their friends on board, Revolut has created a viral loop that drives even more activation and growth.

Revolut’s data shows that:

- The first 300,000 users typically had 5 contacts in the system

- These early adopters had an average age of 34 years old

- On average, they had a turnover of 95 Euros

By laser-focusing on getting users to their “aha moment” as quickly as possible, Revolut has achieved incredible activation rates and set the stage for long-term retention and growth.

The lesson here is clear:

If you want to turn new users into lifelong fans, you need to help them experience your app’s core value as early as possible.

Retention 🔒

At the heart of Revolut’s retention strategy is a simple principle:

Make the app so useful, so essential, and so delightful that users can’t imagine their lives without it.

To achieve this, Revolut has built an ecosystem of features and services that cater to every aspect of their users’ financial lives.

From budgeting tools and savings vaults to cryptocurrency trading and travel insurance, Revolut has created a one-stop shop for all things money-related.

But Revolut isn’t just relying on features to keep users engaged – they’re also leveraging the power of personalization and gamification to create a truly addictive experience.

For example, Revolut uses data-driven insights to provide users with customized recommendations and insights into their spending habits.

This not only helps users make better financial decisions but also makes them feel like Revolut really understands and cares about their individual needs.

On top of that, Revolut has introduced gamification elements like challenges, rewards, and leaderboards to make managing money feel less like a chore and more like a fun, engaging game.

The result of all these efforts is a retention rate that’s the envy of the fintech world.

According to Revolut’s data, the app’s user retention rate is a mind-blowing 98% – showing the incredible staying power of their product.

Referral 📣

Revolut’s referral program is the No1 growth lever that brought them where they are now.

Here’s how it works:

- Revolut users can earn rewards by inviting their friends to join the app using a unique referral link.

- When a friend signs up and starts using Revolut, both the referrer and the referee get a sweet bonus.

But to make it work Revolut made the referral process as easy as possible.

Users can invite friends directly from the app, either by sharing their referral link via social media and messaging apps or by using the in-app contact list to send invitations.

The genius of Revolut’s referral program lies in its viral potential.

By incentivizing users to bring their friends on board, Revolut has created a self-perpetuating growth loop that keeps bringing in new users without any extra effort on their part.

And the best part?

Referred users tend to be highly engaged and loyal, since they’ve joined the app on the recommendation of someone they trust (WoF Rules!).

This means that Revolut isn’t just acquiring new users through referrals – they’re acquiring high-quality, long-term users who are more likely to stick around and keep using the app.

The results speak for themselves.

According to Revolut’s data, over 63% of their new users come from referrals

Lessons: Disrupting Slow Movers

Revolut’s wild success shows how you can disrupt old-school industries by combining:

👩💻 Killer digital product development

💰 Growth marketing strategies

🔁 Continuous feedback optimization

🤝 Generous referral programs

🔥 Cultivating user delight

Rinse and repeat for market dominance!

Well, y’all, there’s our deep dive on how Revolut achieved fintech dominance!

Let me know your thoughts about this edition and reply if you’ve got any other growth companies you wanna see featured!

And if you liked our analysis, spread the word faster than Revolut spreads globally!

George Mastorakis is a digital marketer with 12+ years of experience in building and growing online businesses. From affiliate SEO sites and CPA funnels to agency work and leading growth at Synthesys from $0 to $1M ARR, he’s done it all. Today, he helps solo founders build a personal brand and scale their businesses using startup growth tactics he’s refined through years of hands-on experience.

Leave a Reply